3 Responsible financing

Relevance of the topic to SZKB and objectives

Opportunities and risks relating to business conduct vis-à-vis clients can be divided into an inside-out perspective and an outside-in perspective:

- Inside-out: the impact of SZKB’s financing activities on the environment: SZKB’s financing activities have a direct impact on environmental, social and economic aspects. Through targeted lending, the Bank can foster innovation, create jobs and support sustainable projects. At the same time, it helps to positively structure regional and supra-regional developments by promoting responsible business practices. However, financing also entails risks such as high CO₂ emissions, poor working conditions or loss of biodiversity.

- Outside-in: The impact of external factors on SZKB’s financing activities: SZKB’s financing activities are influenced by external ESG factors such as climate change, regulatory changes and societal trends. Climatic risks, such as physical damage to assets or interruptions in supply chains, can affect the creditworthiness of borrowers and thus increase the risk of credit defaults. In addition, stricter legal requirements in areas such as environmental and social standards have a direct impact on the economic stability of client companies.

For this reason, SZKB has defined "financing a sustainable property", "access to sustainable financial services" and "climate change" as key topics in the area of responsible financing1.

SZKB has defined the following targets in the area of responsible financing (for climate targets see Chapter 5 Climate Report):

- Development of financing products that foster and support sustainable behaviour.

- Raising awareness among clients.

- Raising awareness among employees.

- Creation of incentives, such as favourable interest rates, to facilitate a decrease in emissions intensity.

- Support with the generational transfer of a property.

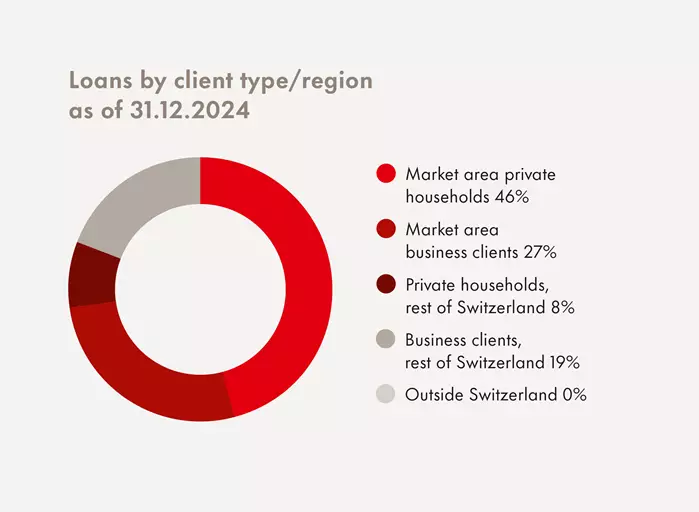

Due to its balance sheet volume and its contribution to business income, the lending business will play an important role in SZKB’s business model. The Bank focuses on business with private, commercial and corporate clients primarily in the Canton of Schwyz and neighbouring regions. Being the largest lender in the Canton, SZKB wields influence over the flow of funds through loans and investments. It therefore plays a key role in the sustainable development of the Schwyz economic region and assists private, commercial and corporate clients over generations.

1 The key topic of «climate change» is covered in Chapter 5 Climate Report and is not addressed in this chapter.

Management approach

a sustainable mortgage portfolio

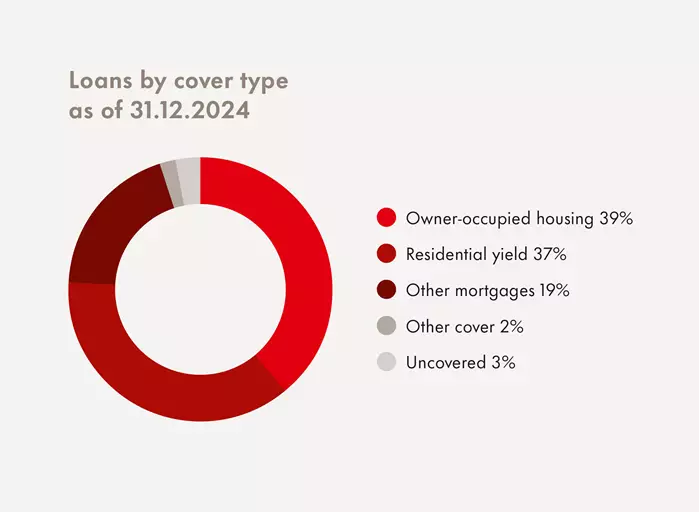

As the leading bank in the Canton of Schwyz for private and business clients, SZKB is primarily active in the mortgage business and concentrates on its market area. This includes the Canton of Schwyz and neighbouring regions in which SZKB possesses extensive market expertise. The regional allocation is based on the location of the property for mortgage insurance and the debtor’s domicile for all other types of insurance. The Schwyzer Kantonalbank Act limits the foreign assets of SZKB to a maximum of 5% of the balance sheet total. As a result of internal regulations, the financing business can account for a maximum of 0.5% of this. Mortgages are not granted to clients with covered properties outside Switzerland. Whenever a mortgage is granted, both affordability and the loan-to-value ratio are examined, including from a sustainable perspective.

The advice given to clients actively considers ESG issues and raises their awareness at the same time. SZKB has made the topics of sustainability and energy efficiency an integral part of the consultations with private clients. With sustainable products, such as the "handshake mortgage", issues such as energy-efficient renovation are explicitly discussed and addressed in the consultation. A variety of tools, including the myky partner platform or factsheets, are used for illustration purposes. By partnering with myky, a property projection can be created for clients using an online application, which makes it possible to establish the energy status. For more detailed advice, clients are actively referred to external experts. SZKB also plans to expand its financing solutions for all clients, including business clients.

Sustainable loan portfolio

SZKB manages the impact of responsible financing also through the credit products it offers and the established credit processes. To date, SZKB has not yet recorded any exclusions in internal documents or regulations in the lending sector. In future, it will complement established credit processes by incorporating sustainability aspects in the interests of the environment.

Special sectors:

- Due to the restriction on foreign engagement and sectoral composition, as of 31 December 2024; there is no direct financing in the following areas: Arctic drilling, oil sands/fracking, coal extraction, mining.

- Agriculture in Switzerland, and in the Canton of Schwyz in particular, is dominated by small-scale farms. The average usable area per farm in the Canton of Schwyz is 16 hectares. SZKB does not have any exclusions for financing specific business sectors. The regulations of the Canton determine the maximum amount of financing available for the specific agricultural enterprise. Legislation sets out extensive requirements for land management (environmental protection, biodiversity, water protection, sustainable land use) and animal welfare. Control mechanisms have been put in place by the state.

- SZKB also provides financing for companies that produce renewable energy, specifically in the areas of district heating and hydropower. Furthermore, loans are provided to support smaller-scale solar power installations and energy-efficient renovations for private, commercial and corporate clients, as well as non-profit housing developers. SZKB also provides financing for hospitals, retirement and nursing homes and other social institutions and handles student loans granted by the Canton of Schwyz.

SZKB has decided to discontinue its consumer credit range for sustainable and strategic reasons. In the past, applications in this area were forwarded to a partner bank for review and processing. This partnership was terminated at the end of 2024, and SZKB will no longer offer consumer credit in future.

Sustainable financing products

SZKB defines general financing rules in an internal directive. Among other things, it states that creditworthiness and credit eligibility must be checked in relation to each commitment. SZKB is willing to support its clients even under challenging circumstances, also as part of its statutory mandate. SZKB supports clients throughout all phases and across generations. For this purpose, it has developed a consulting solution for the transfer of an owner-occupied property to the next generation that considers the individual circumstances and needs of clients (see Chapter 3.3 "Access to sustainable financial services", section Supporting clients throughout all phases.

The internal directive on non-performing commitments requires, among other things, that clients with higher default risks must receive specific support from a specialist recovery team. SZKB is committed to working with its clients to identify sustainable solutions whenever possible. It is also possible to make adjustments to the loan terms, taking into account the default risk. The SZKB recovery team supports client advisors in relation to non-performing commitments and provides training for this purpose. The processes and guidelines are set out in an internal work instruction on mortgages and credit monitoring. The risks taken must always be quantifiable. Individual establishments or sectors are not kept on their feet simply for the sake of it.

SZKB also works with the Guarantee Fund of the Canton of Schwyz to provide clients with access to additional sources of financing. The Guarantee Fund is a cantonal institution with a legal personality, and its registered office is in Schwyz. The purpose of the fund is to provide guarantees for loans, credits and guarantees for natural and legal persons resident or domiciled in the Canton of Schwyz who prove to be creditworthy and trustworthy. The fund is used to guarantee loans, credits and guarantees for which no or no fully bankable cover can be provided and which are needed for the following purposes:

- For the acquisition, construction, maintenance and improvement of residential buildings, condominiums and commercial and agricultural real estate (real estate loans)

- For the construction, maintenance, improvement and expansion of service enterprises as well as commercial, industrial and agricultural businesses (operating loans)

- For start-up and venture financing of companies

SZKB is responsible for reviewing applications and processing such loans. With this instrument, Schwyzer Kantonalbank can provide additional clients with sustainable access to financing, which also supports the promotion of business activity in the Canton of Schwyz.

Key measures

During the reporting year, SZKB focused on "financing a sustainable property" and "access to sustainable financial services" as key topics in the area of responsible financing:

- Developing a sustainable credit portfolio and improving its quality overall

- Providing energy-efficient renovation products and further developing them

- Raising awareness of employees and clients

- Supporting clients throughout all phases and across generations

Developing a sustainable credit portfolio and improving its quality overall

SZKB is heavily active in the mortgage business and focuses on its core markets in the Canton of Schwyz and neighbouring regions. Thanks to its long-standing market knowledge and close client relationships, it is able to respond in a targeted and sustainable manner to the needs of its private and business clients. The regional allocation for mortgages and other types of financing is based on the location of the property for mortgage insurance and the debtor’s domicile for all other types of insurance.

Providing energy-efficient renovation products and further developing them

SZKB launched its "handshake mortgage" as a standardised product for financing energy-related renovations at the beginning of 2024. With this product, SZKB clients with owner-occupied properties in the Canton of Schwyz can benefit from subsidised loans up to a maximum of CHF 75,000, additional advice and a surety from the surety fund financed by SZKB for measures intended to increase the energy efficiency of their properties. Application and processing have been simplified for clients and interest has been made extremely attractive in order to create additional incentives for energy-efficient renovations. The solution is free of charge and interest-free in the first year. The arrangement is also characterised by flexible use and processing.

SZKB will soon launch another energy financing product for amounts up to CHF 500,000. This solution is available to all clients, especially commercial clients. Client advisors consistently integrate the issue of sustainability into advice in relation to all residential property financing and discuss possible solutions with the clients.

Raising awareness of employees and clients

The Swiss Bankers Association (SBA) has adopted two guidelines in the area of sustainable finance, setting out binding sustainability requirements for investment advice and asset management, as well as mortgage advice1. As a member of the SBA, these requirements are mandatory for SZKB and were implemented on time, which also requires long-term value preservation (in particular the need for energy-efficient renovation) to be addressed as part of the advisory process. At SZKB, the topics of sustainability, ESG and energy efficiency are an integral part of consultations with private clients, which at the same time results in the raising of their awareness. In addition, through the "Clever@SZKB" series, SZKB has established an additional channel for increasing the competence of the general public in the Canton of Schwyz in relation to various financial issues, including the topic of "renovating your home" (see Chapter 2.1.2 "Client satisfaction", section Providing training and courses for clients).

SZKB supports the advanced training of all employees and raises their awareness through various training programmes and refresher courses, such as a bank-wide ESG e-learning course (including processes relating to energy-efficient renovations or sustainable investments for front office employees) for all employees or through a specialist course in sustainable finance specifically designed for SZKB in cooperation with the Lucerne University of Applied Sciences and Arts (see Chapter 2.2.2 "Diversity and integration", section Training and education).

Supporting clients throughout all phases

As a generational bank, SZKB supports its clients in the transfer of residential property within the family. For this purpose, SZKB has developed a consulting solution that considers the individual circumstances and needs of clients. SZKB offers a tailored solution that is suitable for both current and future homeowners. For this purpose, individual circumstances are discussed, and the needs of all parties involved are examined in a personal meeting. The comprehensive expertise of client advisors in the areas of asset accumulation, asset management, financing, and pensions is provided holistically to clients and their families before, during and after the transfer of their home. In addition, a selection of proven financing products are offered that are individually tailored to the respective situation.

The multi-generation advisory solution is comprised of four pillars:

- Clarifying the financial basis

- Identifying targets in relation to the home

- Finding the right solution

- Transferring the property

The consulting solution offered is not classified as a sustainable financing product in a strict sense, such as in regard to environmental or social criteria. Nevertheless, it helps foster a sustainable client relationship by offering transparent solutions that are viable over the long term and that meet the individual needs of clients. This individual approach supports a long-term partnership characterised by trust.

1 "Guidelines for mortgage providers on the promotion of energy efficiency" and "Guidelines for the financial service providers on the integration of ESG preferences and ESG risks and the prevention of greenwashing in investment advice and portfolio management".

Assessment of effectiveness

During the reporting year, the focus in terms of responsible financing was on the implementation and further development of products and processes in relation to compliance with the "Guidelines for mortgage providers on the promotion of energy efficiency" of the Swiss Bankers Association (SBA) in regard to the key topic of "financing a sustainable property" and the key topic of "access to sustainable financial services". SZKB has achieved the following milestones:

- SZKB launched its «handshake mortgage» as a standardised product for the financing of energy-efficient renovations for private clients at the beginning of 2024. It is set to be extended soon to commercial clients (including investment and commercial properties). In the same year, the multi-generation advisory solution was also introduced. This solution enables families to keep a home in the family across multiple generations and to pass on residential property from generation to generation. SZKB has been able to expand its product range accordingly.

- SZKB has made sustainability, ESG and energy efficiency an integral part of consultations with private clients with owner-occupied homes or holiday homes, thus helping to raise awareness among clients.

- SZKB developed a project plan for incorporating ESG criteria into the credit check and credit approval process and for examining other sustainable financing products.

SZKB considers the measures taken to be appropriate and effective.

Further development and next steps

In 2025, SZKB will further advance sustainability efforts through responsible financing in the following areas:

- Examining further sustainable financing products and further developing existing sustainable financing products.

- Developing training courses for accumulating knowledge about sustainability, the corresponding regulatory requirements and SZKB products and processes.

- Developing the catalogue of criteria and implementing exclusion criteria in the financing process (including consideration of ESG criteria within credit assessment).