5 Sustainability in the area of social affairs

With 610 employees (excluding hourly staff, including trainees and interns), SZKB is one of the largest employers and trainers in the Canton of Schwyz. The workforce has shown healthy growth in recent years, and the rate of turnover has remained low. Personnel expenses amounted to CHF 83.0 million in 2022, slightly above the previous year’s figure of CHF 81.4 million.

In the Canton of Schwyz, SZKB is a key employer and trainer with responsibility for its home region. It puts its focus on matters including the promotion of young talent, continuous professional and personal development, a modern remuneration system, attractive fringe benefits, flexible working models, work-life balance and equal pay and opportunities.

Employees are a decisive factor for the success of SZKB. SZKB is therefore committed to regular and systematic further development of all its employees and managers. This is to ensure that they have the knowledge relevant to their activities and are also equipped to meet the ever-rising demands of the future. To this end, SZKB regularly offers internal continuing education resources in the form of courses, seminars, workshops and management conferences while also supporting further training that individuals obtain externally (with up to 100% of costs covered by the Bank). SZKB also operates its own talent programme and a leadership programme.

The strategic responsibility for human resources policy lies with the Bank Council and the Executive Board. The Human Resources department is responsible for operational implementation of the HR strategy and nurturing of high potentials and managers. It organises and is responsible for the HR strategy in the areas of digital transformation, strategic HR projects, optimisation of processes and directives, and HR communication.

SZKB bears social responsibility in the Canton of Schwyz. It makes an important contribution to increasing the financial literacy of Cantonal residents, such as by repeatedly offering public lecture series on the topic of «pension provision», sometimes in cooperation with partner institutions in the Canton of Schwyz.

Switzerland has well-developed social security systems and fair labour law conditions that also apply to the employees of SZKB:

- All residents of Switzerland are compulsorily insured against illness.

- All employees are compulsorily insured against occupational accidents and, if they work more than eight hours per week, also against non-occupational accidents. Starting from the 4th month of SZKB employment in an unlimited employment relationship, continued payment of salary in the event of accident or illness is at a rate of 100% from the 4th to the 12th month and at a rate of 80% from the 13th to the 24th month.

- In Switzerland, old-age and survivors’ insurance (AHV) is compulsory for old-age provision, and a pension fund is also compulsory above a certain income. SZKB is affiliated with the Pension Fund of the Canton of Schwyz (PKS). SZKB has also additionally insured its employees in PK Plus since July 2021.

- In Switzerland, all employees are entitled to at least four weeks of holiday per year. Once per calendar year, a holiday is to be taken in the form of an uninterrupted holiday period lasting at least two weeks. SZKB grants its employees at least five weeks of holiday per calendar year.

- The principle of equal pay for men and women has been enshrined in the Swiss Federal Constitution since 1981.

- Child labour has been banned in Switzerland since the 19th century.

SZKB introduced a new remuneration model for all employees as of 1 April 2022. This remuneration model meets the transparency requirements imposed by the Swiss Financial Market Supervisory Authority (FINMA) and makes it possible to understand how remuneration is determined.

The remuneration model is based on levels 1 to 8 for employees and levels 9 and 10 for members of the Executive Board. Assessment and classification of occupational profiles into levels are based on an analytical functional assessment that was approved by the Executive Board. The function evaluation of an occupational profile is carried out independently of the person and includes an assessment of the contribution of each function to the company’s success according to uniform and objective criteria.

Employees who have a level 1 or 2 occupational profile receive a fixed basic remuneration. Employees in levels 3 to 8 may receive variable remuneration in addition to their fixed basic remuneration. The salary bands assigned to each level were determined by market benchmarking.

The amount of the individual variable remuneration is determined by performance – which in turn is dictated by the results achieved and the conduct exhibited by the employee – and depends on the total amount available. There is no legal entitlement to variable remuneration, even if variable remuneration was paid in previous years. There is no reduction in variable remuneration for absences during normal maternity leave.

The ratio between the highest salary (including variable remuneration and strategy bonus) and the median salary (including variable remuneration, salaries adjusted to 100%) was 7.5:1 in 2022. The median salary includes employees who were employed as of 31 December 2022 (excluding Bank Council members, employees paid on an hourly basis, apprentices and interns).

The remuneration model of the SZKB Executive Board follows the same scheme as that of the employees, consisting of a fixed basic salary and a variable component. Half of the variable remuneration relates to the individual performance (results and conduct) of the respective member of the Executive Board as well as to the achievement of strategic performance criteria of the entire bank in the past financial year. One-third of the strategy bonus is paid out with a time delay (deferred compensation). The Bank Council defines the key performance indicators (KPI).

Exceptional performance can be rewarded with a one-off bonus. This makes it possible for individuals or even entire teams to be rewarded directly for their commitment in response to a specific occasion or circumstance.

There is no salary component in the form of shares or options since SZKB, as an independent institution under Cantonal public law, is wholly owned by the Canton of Schwyz.

From a management perspective, the annual HR process begins in January and February with an agreement of objectives between managers and their employees, with expectations clarified in a discussion and the agreed objectives recorded in writing. The interim appraisal between managers and employees takes place from June to August, when the achievement of objectives in the first half of the year is discussed retrospectively. In September and October, managers and their employees conduct development discussions, during which the development objectives and possible steps to achieve the objectives of each individual employee are discussed and recorded in writing, separate from the annual HR process. Finally, in November and December, the end-of-year assessment of the entire year takes place, bringing the HR annual process to a close.

In addition to the annual HR process, the leadership tool «People Days» was launched in 2022. At the end of the year, the managers of each business unit jointly discuss and calibrate the performance and potential assessments of the employees. This process creates a uniform understanding of the assessments based on fairness and broadly supported feedback. The performance and potential assessments resulting from the People Days form the basis for the remuneration development of all employees. For employees on levels 3 to 8, the performance evaluation also represents a component for the assessment of the individual variable remuneration.

The Human Resources department carries out evaluations to avoid distortions in the assessment («bias», such as in regard to employee gender, age or level).

SZKB had its gender pay gap analysed externally in 2021 and then had this analysis reviewed by PricewaterhouseCoopers. The 2021 result confirmed that there is no gender effect in compensation. At 2.2%, the observed adjusted wage gap is clearly below the tolerance value of 5.0%, meaning that there is no discrimination on the basis of gender. Equal pay will also be subject to ongoing review in future.

SZKB is committed to the equality of women and men in professional life. All functions are open to all genders, and the remuneration model is designed to be gender neutral. SZKB attaches particular importance to equality when it comes to staffing, training and continuing education, as well as remuneration and human resources development.

SZKB attaches great importance to the reconciliation of career and family responsibilities and fosters this ideal with flexible working hours, arrangements for working from home and, as one of the few banks in Switzerland to do so, attractive childcare allowances. Support is provided per day of third-party care, whether care is provided in a daycare centre, in a childminder’s home or by a nanny. Starting from a 50% workload, every female employee (or single parent) is entitled to benefit from the «childcare contributions» offer. Part-time positions are possible for both women and men. SZKB particularly wants to keep women

and men with family care responsibilities in the workplace, especially single parents. With this contribution, SZKB is creating the conditions for higher workloads and sustainable careers for its employees. As part of its equal opportunity policy, SZKB is also striving to further increase the proportion of women in management positions.

Every year, the internal SZKB women’s network offers numerous events, networking meet-ups and continuing education courses on the topic of «women and professional development» that are open to all female employees of

SZKB. SZKB supports the women’s network with an annual contribution. In the spirit of inclusion, an SZKB Women’s Network event was also offered for men in 2022.

Together with local cooperation partners in the Canton of Schwyz, SZKB is also a co-initiator of the newly created Schwyz Mentoring Programme, which began in October 2022 with the purpose of empowering women in their career planning, use of networks, reconciliation of work and family life, and topics relating to occupational pensions (see chapter 11.8 Mentoring Programme).

The Human Resources department is responsible for developing and monitoring diversity, equality and inclusion within SZKB. This actively advocates on an ongoing basis for causes such as increasing the compatibility of work and

family/leisure time, advancement of women, lifelong learning and equal pay.

SZKB has amended its rules and regulations for personnel with effect from 1 April 2022. Major changes to further increase the attractiveness of the Bank as an employer were:

- Introduction of one-time sabbaticals when the service anniversaries of 15, 20, 25, 30, 35, 40 and 45 years are reached. The sabbaticals must last at least 6 weeks, with SZKB contributing 20 working days in each case.

- Employees receive credit for all previous years of service at SZKB (including apprenticeship/internships and periods of hiatus from work).

- In addition to ordinary birth, child and education allowances stipulated by Cantonal legislation, SZKB pays a voluntary family allowance to all employees until their children reach the age of 20. The allowance is calculated according to the employee’s current employment level and is also paid if the relevant child and education allowances are received by the employee’s partner and not settled via the Bank.

- Adjustment of the terms and conditions of SZKB products and services in regard to personnel.

- Extension of certain preferential terms and conditions to partners living in the same household.

- All employees of SZKB, including part-time employees and employees paid on an hourly basis with permanent employment contracts, benefit in full from the revised conditions of employment.

SZKB is an attractive employer. The following policy applies to the terms and conditions of employment:

- Each basic salary comprises 13 monthly salary payments. Half of the 13th monthly salary payment is paid in June and half in November.

- Length of service awards begin to be conferred starting from the completion of 10 years of service.

- Insurance of the total salary without coordination deductions with the Pension Fund of the Canton of Schwyz as well as the supplementary pension plan PK PLUS for employees without a management pension plan. The aim of PK PLUS is to enable employees to create additional retirement capital or a retirement pension by offering them the opportunity to make additional personal contributions to the pension scheme, depending on their income level. PK PLUS also offers additional cover in the event of death or disability. SZKB is responsible for financing the risk and administrative costs of PK PLUS.

- The weekly working time is 42 hours. It must be adhered to as an annual average.

- Employees whose functions and duties are compatible with work from home without negatively affecting operations may work from home for up to 4 days per week if they have a workload of 100%.

- Five weeks of holiday (up to age 49), 28 working days (from age 50 to 59 and apprentices) and 30 working days (starting from age 60). SZKB employees are also entitled to days off or hours off for special occasions.

- Taking special account of each person’s work/life situation, SZKB offers its employees the option of purchasing additional holiday days amounting to 5 days per calendar year in addition to their holiday entitlement.

- Generous terms of salary payment continuation in case of inability to work.

- 100% of the salary is paid during 4 months of maternity leave and 10 days of paternity leave. All employees who were entitled to parental leave have taken it.

- Financial contribution to external childcare starting from a minimum workload of 50 (for mothers and single fathers).

- Free childcare counselling and referral services.

- Annual maximum of CHF 1,000 in REKA cheques (a community currency backed by the Swiss Travel Fund) at a 20% discount.

All the above-mentioned employment terms and conditions are also available to SZKB employees on a part-time basis. For employees paid on an hourly basis, the provisions in regard to working hours, holidays and remuneration do not apply.

SZKB attaches great importance to a corporate culture that fosters health and strives to keep the risk of occupational illnesses as low as possible. SZKB is greatly concerned with the physical and mental well-being of its employees.

Workplace ergonomics is a priority. Employees are provided with height adjustable office desks that allow them to work while standing. No ergonomics consultations took place in 2022, but the ergonomic equipment of workplaces at SZKB as well as ergonomic information and recommendations for working from home will be maintained in the future.

Every employee has the right to contact the responsible supervisor or the Human Resources department if they feel that their position has been compromised by other employees or supervisors (see chapter 7.6 Whistleblowing).

To foster prevention, SZKB pays for a comprehensive health check-up for employees starting from the age of 44, contributing a maximum of CHF 500 to the costs not covered by health insurance every three years.

SZKB’s occupational health management is based on three specific pillars: prevention, intervention and integration. In the area of prevention, employees and managers are to receive targeted offers in the area of health promotion as well as valuable tips and advice on maintaining their health and how to better deal with stress at work. In 2023, a preventive campaign focusing on stress, headaches and sleep disorders will be conducted with a renowned external partner. In the area of intervention, SZKB aims to help prevent long-term health-related absences using clear processes and suitable tools. In the area of integration, employees and managers are to receive professional support and advice in the event of prolonged health-related absence from work to ensure that professional and social reintegration is successful or, if applicable, that a smooth transition to disability insurance (DI) can be made.

Care management also provides support to employees in the event of long-term illness and situations in which they are not able to fully perform their work.

SZKB ensures secure jobs with its long-term business policy. The 14 strategic initiatives for the new SZKB strategy period of 2023 and following target long-term and sustainable growth without job cuts. There were neither strikes nor mass redundancies at SZKB in 2022.

The Human Resources department remains in close exchange with the board of the Bank’s internal staff association. The Executive Board of the staff association represents the interests of the employees and consists of eight representatives from among the ranks of the employees. SZKB supports the staff association with an annual contribution.

SZKB nurtures an active and open corporate and feedback culture in which employees are encouraged to resolve disagreements without delay. Specific team interventions and team workshops are conducted to improve cooperation and prevent potential for conflict from arising. If these are insufficient or impossible, the formal grievance process is conducted by the supervisors, who treat the grievance in a confidential manner and take the necessary steps to resolve it. Corresponding reports are to be treated confidentially. In 2022, there were no reports to the internal reporting office for grievance management and whistleblowing (see chapter 7.6 Whistleblowing).

SZKB fosters a positive culture of leadership and cooperation. This is reflected in the SZKB slogan («Seit Generationen. Für Generationen. Gemeinsam hier vor Ort.») as well as in the four principles (heart, focus, handshake and opportunity). The culture of addressing everyone on a firstname basis across all hierarchical levels, as well as regular events for sharing information, networking and fostering exchange among all employees, also contribute to employees feeling a sense of belonging at SZKB.

SZKB prioritises employee satisfaction. In order to assess this factor, regular employee satisfaction surveys are conducted alongside the ongoing feedback discussions. Appropriate measures are derived from the results. In future, the Bank will also accept suggestions for improvement, which will serve as the basis for ongoing further development of SZKB as an attractive employer. The most recent survey took place in 2021 and produced a very good result, with 78% of employees stating that they were satisfied with their work situation. This is an increase of 3% compared to the 2017 survey. The next employee satisfaction survey will take place in 2023.

Well-trained employees are a crucial factor for SZKB’s success, so training and continuing education are of great importance at SZKB:

- SZKB trains 29 apprentices in the professions of management assistant (banking sector) and IT specialist (platform development) while also engaging five interns as part of the Bank entry-level programme for secondary school graduates. In 2022, SZKB also decided to offer training for a new occupational profile starting in summer 2023 by creating an internship spot for graduates of IT secondary school (specialising in application development) for the first time.

- Since 2021, SZKB has been conducting its own leadership programme to continuously develop and improve the expertise of its managers in regard to SZKB’s understanding of leadership. SZKB’s leadership understanding is based on the three pillars of «clarifying expectations», «tapping into potential» and «nurturing relationships». All of the roughly 100 SZKB managers completed this leadership programme, which lasts several days. It will be continued in 2023.

- SZKB offers its own talent programme for high potentials, which offers 12 employees the opportunity to expand their leadership abilities and skills relating to methodology, dealing with people and collaborating across departments, while also expanding their network over a period of 18 months. Four women and eight men are participating in the 2021–2023 talent programme. The talent programme is scheduled to start again in 2024.

- SZKB has its own digital learning platform. Each year, numerous internal courses and training opportunities are offered as mandatory or voluntary events.

- In 2022, mandatory training in the areas of compliance, information security and sustainable investments took place for all employees – with varying degrees of indepth training in some instances. Courses on security-related aspects and robberyprevention are also held every year as mandatory events for employees responsible for security. Numerous voluntary events on topics specific to the Bank as well as in regard to human resource issues were offered regularly and always very popular.

- In addition to internal courses and training, SZKB covers up to 100% of the cost of external training and continuing education that employees complete alongside their normal work (e.g. bachelor’s and master’s degrees, CAS, MAS) in accordance with internal directives. In 2022, SZKB’s financial commitment for internal training activities and participation in external training courses amounted to CHF 824,000, while the Bank’s financial commitment to basic training was CHF 311,000.

- Within 24 months of taking up their advisory role, all client advisors at SZKB must complete the personal certification corresponding to their occupational profile in accordance with the requirements of the Swiss Association for Quality (SAQ), which confirms that they have the necessary skills to advise clients well. The certificate has a validity period of three years and can be extended by documenting at least 24 learning hours or by retaking the exam. SZKB offers internal training opportunities that are accredited by the SAQ, so that the required learning hours can be verified for recertification of the certificate obtained.

- Employees without basic training in the area of banking are offered the opportunity to complete the Banking Course, which is held annually in cooperation with other

Cantonal banks. - The number of person-days for participation in internal and external training and continuing education courses are not available.

Since 2019, SZKB has been participating in National Future Day. SZKB also implemented the special project «A Day As the Boss» for the first time in 2022. The special project was intended to serve 6th- and 7th-grade girls without a caregiver at SZKB who wanted to gain insight into what the everyday working life of a female manager at SZKB is like.

In a programme designated «Change of Perspective», SZKB provides all employees with a day off from work to engage in charitable activities every two years. In the Canton of Schwyz, there were around 60 projects to choose from for volunteering for the benefit of people and nature in 2022. Another 40 volunteer projects were also submitted by employees. For Change of Perspective 2022, 146 person-days (volunteering in full or half days) were reported. This did not include days of volunteering by vice directors, as they do not record their time.

As part of Change of Perspective 2022, the Executive Board of SZKB visited the management of the BSZ Foundation in the Canton of Schwyz, an organisation committed to the concerns of people with support needs and the third-largest employer in the Canton of Schwyz.

Numerous SZKB employees are privately involved in various associations and political functions outside the Bank. All secondary employment (that is, also including work outside associations and not in political functions) must be approved by a member of the Executive Board. In 2022, 241 employees received approval to engage in secondary employment. SZKB provides up to 5 days/year for the exercise of an approved public office.

All employees are currently either male or female at SZKB. There are no employees who have declared that they are of a different gender or of no gender.

SZKB works with various partners on a contractual basis, but the Bank does not have any figures on the number of these contractual relationships.

SZKB does not employ any staff on an on-call basis.

No key figures from previous years or changes compared to previous years are shown, as this is the first time that the Sustainability Report was prepared. No figures from previous years are available, as a new HR system was rolled out

in 2022, and there is no comparability of figures from the two different systems.

All key figures without employees paid on an hourly basis, including apprentices and interns

| Number of employees, employment relationship and employment level (GRI 2–7) | 2022 | 20211 | 20201 |

|---|---|---|---|

| Total number of employees | |||

| Number of personnel units (full-time equivalents)2 | 525.3 | ||

| Number of employees (persons)3 | 610 | ||

| thereof in the Executive Board | 5 | ||

thereof per level:4 | 162 | ||

| Level 3 – 4 | 179 | ||

| Level 5-6 | 220 | ||

| Level 7-10 | 49 | ||

| thereof number of apprentices | 29 | ||

| thereof number of trainees | 5 | ||

| Employees paid on an hourly basis5 | 35 | ||

| Employees by employment relationship (permanent/temporary/hourly paid)6 | |||

| Permanent employees7 | 603 | ||

| thereof women | 268 | ||

| thereof men | 335 | ||

| Temporary employees8 | 7 | ||

| thereof women | 2 | ||

| thereof men | 5 | ||

| Employees paid on an hourly basis9 | 35 | ||

| thereof women | 34 | ||

| thereof men | 1 | ||

| Employees by employment level (full-time/part-time)10 | 1 | ||

| Full-time employees | 399 | ||

| Women in full-time employment (compared to total headcount) | 19.3% | ||

| Women in full-time employment (compared to all women) | 43.7% | ||

| Men in full-time employment (compared to total headcount) | 46.1% | ||

| Men in full-time employment (compared to all men) | 82.6% | ||

| Part-time employees | 211 | ||

| Women in part-time employment (compared to total headcount) | 24.9% | ||

| Women in part-time employment (compared to all women) | 56.3% | ||

| Men in part-time employment (compared to total headcount) | 9.7% | ||

| Men in part-time employment (compared to all men) | 17.4% | ||

| New hires and employee turnover (GRI 401-1) | |||

| New employees11 | |||

| Number of employees (persons) | 67 | ||

| thereof employees under 30 years | 29 | ||

| thereof employees under 30 years (in per cent) | 43.3% | ||

| thereof employees between 30 and 50 years | 32 | ||

| thereof employees between 30 and 50 years (in per cent) | 47.8% | ||

| thereof employees over 50 years | 6 | ||

| thereof employees over 50 years (in per cent) | 9.0% | ||

| thereof women | 31 | ||

| thereof women (in per cent) | 46.3% | ||

| thereof men | 36 | ||

| thereof men (in per cent) | 53.7% | ||

| Employee departures12 | |||

| Annual turnover rate (net) | 59 | ||

| thereof employees under 30 years | 10 | ||

| thereof employees under 30 years (in per cent) | 16.9% | ||

| thereof employees between 30 and 50 years | 36 | ||

| thereof employees between 30 and 50 years | 61.0% | ||

| thereof employees over 50 years | 13 | ||

| thereof employees over 50 years (in per cent) | 22.0% | ||

| thereof women | 28 | ||

| thereof women (in per cent) | 47.5% | ||

| thereof men | 31 | ||

| thereof men (in per cent) | 52.5% | ||

| Turnover (in per cent) | |||

| Annual turnover rate (net)13 | 10.3% | 7.1% | 6.3% |

| Annual turnover rate (gross)14 | 14.5% | 11.3% | 10.7% |

| Parenthood (GRI 401-3) | |||

| Parental leave after the birth of a child15 | |||

| Employees who took maternity leave | 15 | ||

| Employees who took paternity leave | 13 | ||

| Returning to work after parental leave16 | |||

| Number of employees who returned to work | 26 | ||

| thereof number of women | 14 | ||

| thereof number of men | 12 | ||

| Return rate after the end of parental leave17 | 92.9% | ||

| for women | 93.3% | ||

| for men | 92.3% | ||

| Training and education (GRI 404-1) | |||

| Overview (GRI 403-1) | |||

| Total employees in training | 34 | ||

| thereof apprentices | 29 | ||

| thereof interns | 5 | ||

| Employees engaging in external training and education alongside work (GRI 402-2) | 49 | ||

| Number of degrees at the tertiary level | 31 | ||

| Number of SAQ certifications | 7 | ||

| Number of Banking Course completions | 9 | ||

| Training costs (own standard) | |||

| Total external training costs in CHF million | 0.97 | ||

| Total external training costs as a percentage of human resource expenses | 1.2% | ||

| Total external training costs, CHF per employee | 1'590.74 | ||

| Diversity | |||

| Governance bodies (GRI 405-1)18 | |||

| Number of members of the Bank Council: | 9 | ||

| thereof women | 1 | ||

| thereof women (in per cent) | 11.1% | ||

| thereof men | 8 | ||

| thereof men (in per cent) | 88.9% | ||

| Age structure of the Bank Council: | |||

| Proportion of Bank Council members under 30 years | 0.0% | ||

| Proportion of Bank Council members from 30 to 50 years | 44.4% | ||

| Proportion of Bank Council members over 50 years | 55.6% | ||

| Number of members of the Executive Board: | 5 | ||

| thereof women | 1 | ||

| thereof women (in per cent) | 20.0% | ||

| thereof men | 4 | ||

| thereof men (in per cent) | 80.0% | ||

| Age structure of the Executive Board: | |||

| Proportion of Executive Board members under 30 years | 0.0% | ||

| Proportion of Executive Board members from 30 to 50 years | 100.0% | ||

| Proportion of Executive Board members over 50 years | 0.0% | ||

| Age structure (GRI 2-7) | |||

| Employees under 30 years19 | 23.6% | ||

| Employees between 30 and 50 years | 46.4% | ||

| Employees over 50 years | 30.0% | ||

| Levels (own standard) | |||

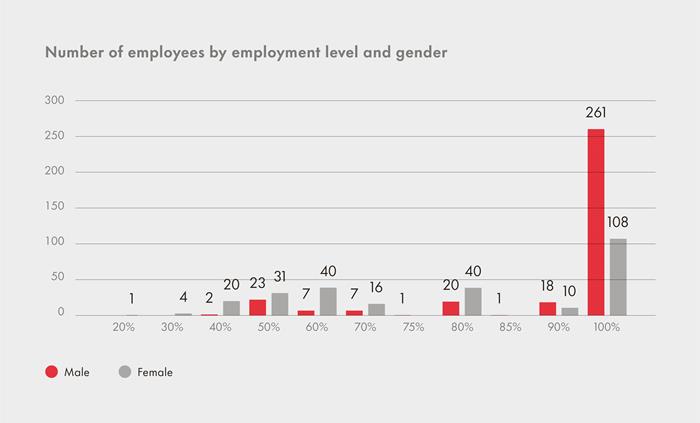

| Proportion of women level 1 – 219 | 67.9% | ||

| Proportion of men level 1 – 2 | 32.1% | ||

| Proportion of women level 3 – 4 | 51.4% | ||

| Proportion of men level 3 – 4 | 48.6% | ||

| Proportion of women level 5 – 6 | 27.3% | ||

| Proportion of men level 5 – 6 | 72.7% | ||

| Proportion of women level 7 – 10 | 16.3% | ||

| Proportion of men level 7 – 10 | 83.7% | ||

| Illness and accidents (GRI 403-1) | |||

| Days of absence per employee | 4.74 | ||

| thereof sick days | 4.45 | ||

| thereof accident days | 0.29 |

1 No key figures from previous years and changes compared to previous years are shown, as the report is being prepared for the first time and a new HR system was rolled out in the reporting year.

2 Excluding employees paid on an hourly basis and banking authority employees, including apprentices and interns (included at 50% as per SNB requirements).

3 Excluding employees paid on an hourly basis and banking authority employees, including apprentices and trainees.

4 Explanation of the levels as per section 5.3.

5 Employees paid on an hourly basis are not included in the other figures.

6 Without banking authority employees.

7 Apprentices and interns are counted as permanent employees. Without employees paid on an hourly basis.

8 Excluding employees paid on an hourly basis.

9 Employees paid on an hourly basis are not included in the other figures.

10 Excluding employees paid on an hourly basis and banking authority employees, including apprentices and interns.

11 New employees with a fixed-term employment relationship are not included.

12 Departures of employees with a fixed-term employment relationship and retired persons are not included.

13 Number of departures of permanent employees (as a percentage of the total headcount at the end of the year).

14 Number of departures (including retirements, deaths and terminations by the employer) (as a percentage of the total headcount at the end of the year).

15 Parental leave refers to statutory maternity leave (for women) and statutory paternity leave (for men).

16 Returning to work refers to all employees who are taking or have taken parental leave during the reporting year.

17 The figure shows the ratio of employees who took parental leave to those who continued working after the end of parental leave.

18 The governance bodies comprise the Bank Council and the Executive Board.

19 Including Executive Board, excluding Bank Council members

SZKB plans to conduct another employee satisfaction survey and a pay equity analysis in 2023.

Special attention will be paid to preventive health in 2023. An awareness campaign for employees is planned and will begin in April 2023. Furthermore, an interdisciplinary project group was commissioned to draft a concept for preventive resources to maintain the motivation and performance of the employees on a lasting basis (see chapter 5.9 Occupational safety and health).

Competition for committed employees remains fierce, and the needs of existing and potential employees are subject to constant change. As the digital transformation continues, employees expect their employer to help provide them with the capacity to keep pace with change. They also appreciate being given sufficient latitude for exercising personal responsibility, flexibility in terms of time and place of work, work/life balance and attractive fringe benefits. The launch of the new strategy period 2023 and beyond, as well as the associated market conditions, led to the emergence of two strategic projects entitled «New Working World» and «Fit for Tomorrow».

The strategic project «New Working World» addresses how work will be done at SZKB in the future and how SZKB’s attractiveness as a modern employer will also be maintained in the coming years.

The strategic project «Fit for Tomorrow» addresses the substance and skill sets of the future in order to counteract Switzerland’s worsening shortage of skilled workers. The project also seeks to promote ongoing development of existing employees at all levels, thereby ensuring their employability and the long-term success of the company.

Another important SZKB action area in the coming years

will be fostering basic financial literacy in the Canton of

Schwyz. The aim is to increase investment awareness and

knowledge about how to prepare for retirement among the general population of the Canton of Schwyz. The Bank is

considering entering into a collaborative partnership with

organizations such as the association «Finance Mission».

SZKB already offers numerous public events in the Canton

on all aspects of preparing for retirement financially, sometimes in cooperation with local partners (including Frauenfachschule Schwyz).